KWSP i-invest is a secure Members Investment Scheme through i-Account with Consolidated View to diversify your retirement portfolio by investing a portion of your EPF savings. All Malaysians & Permanent Residents (PR) who have sufficient savings with the EPF are eligible. Non Malaysians or PR who registered as EPF Members before 1 August 1998 can also participate.

KWSP i-invest User Guide (Buying, Redeem, Switch Processes, Transaction History, Fund Analysis, etc.)

For first time user:

- Go to Member Login Page

- Login: Enter Username and Password

- Select “i-INVEST” on the top Menu

- You will have to complete the Suitability Assessment (SA) which is used to profile you as an investor and enable you to conduct more informed investment decisions.

- Answer the assessment questions

- Next you may use the Fund Tools to help you choose the right Funds

*data shown below may not reflect the current value

Funds Selector – Analysis

Filter the funds you will be interested in for example by Category (Equity, Bond, Mixed Asset, Money Market, Property), Geographical Sector (Malaysia, Global, USA, China, Greater China, etc.), Volatility Classification (riskiness of the fund), Consistent Return Rating (fund’s past performance), etc.

To compare the funds performance, you can select the options to look at the Annualised, Cumulative, Calendar Year Performances, or in the form of Table or Chart.

You can select (check box) the funds that you are interested in and click on “Chart Centre” at the top, to generate the Chart Comparison. Member is advised to make comparison from the same fund category for your assessment, though comparison from different categories are allowed.

Click into the fund to look at it individually in more detail.

How to Buy A Fund

Example: Eastspring Investments Dinasti Equity Fund

Eligible investment amount will be shown on the left sidebar. Fund Charges such as the Annual Management, Trustee, Switching, Redemption Fee and Sales Charge are displayed at the bottom of the page.

Enter investment amount in RM (minimum amount: RM1,000). Click ‘proceed to checkout’.

List of FMI/IUTA funds availability and initial sales charge will be displayed. Click ‘Buy’ button based on FMI/IUTA listings. To understand more about Trustee Fee, Click here.

System will pop up the disclaimer. Click ‘OK’ button to proceed with buy transaction

For breakdown of fund’s investment Sectors, Securities, Equity Holdings, growth measures, etc. you can use morningstar.com

Definitions

Eligible Investment Amount

(Balance in Account 1 – Basic Savings) x 30%

NAV Per Unit

Net Asset Value (NAV) per unit = (Assets – Liabilities) / Total number of outstanding shares

NAV per unit is calculated at the end of each trading day based on the closing market prices of the portfolio’s securities.

The FINANCIAL MANAGEMENT INSTITUTIONS (FMIs) appointed are:

- Unit Trust Management Company – Companies managing member investments in unit trust funds; and

- Fund Management Company – Companies that manage member investment according to their personal mandate.

UNIT TRUST INSTITUTE ADVISOR (IUTA)

A company / agency including a bank that is authorised to market unit trust funds from various FMIs.

Annualized Return

the geometric average of annual returns of each year over the investment period.

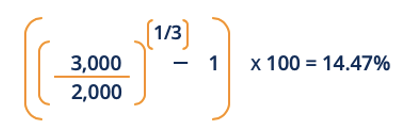

Example (source):

You invest $2000 in a fund. After 3 years, the value from selling the fund is $3000

Annualized return =

Trustee Fee

It is a fee imposed by trustees or custodians for the safeguarding of your assets with FMIs.

Example: If Trustee fee is 0.06% per annum of NAV (market value of all the securities in the fund), subject to a minimum fee of RM18,000 and a maximum fee of RM600,000 per annum.

If NAV is RM800 million

0.06% x 800 million = RM480,000

RM480,000 is more than RM18,000 and less than RM600,000, trustee fee is 0.06%

If NAV is RM1.6 billion

0.06% x 1.6 billion = RM960,000

RM960,000 is more than RM600,000, so trustee fee is RM600,000 = 0.04% per annum

Source

kwsp.gov.my

investopedia.com